Insights From the Forum — Part One

How Growing Wholesale Supplies and Retail Demand Trends Will Drive Transportation Needs

Released August 27, 2015 Article

This past July, ShipCarsNow held the second annual Customer Forum, the goal of which was to network, share information, discuss ways to improve our transportation services and identify opportunities for collaboration across the industry. Attendees included representatives from auto manufacturers, auctions, finance companies, rental fleets, transport companies and analytics firms.

We invited several remarketing industry analysts to provide us with a current market update and outlook. Over the next few months, we will be highlighting some of their findings in our series, “Insights From the Forum.” The first in the series is based on a presentation by Tom Webb, Chief Economist, Cox Automotive.

If you are interested in being part of our Customer Forum next year, let us know!

As wholesale volumes grow and retail margins compress, the efficiency and effectiveness of movement (right place, right time, right cost) takes on added importance.

By the looks of it, growth is ahead for remarketed vehicle volumes. According to Tom Webb, Chief Economist for Cox Automotive, all indicators point to further growth in off-lease volumes beyond 2018, from under 5 million in 2012 to more than 8 million in 2020. The off-lease return rate is predicted to increase 72 percent (847,000 units) between 2015 and 2020, and off-rental rates will also experience growth of 14 percent (107,000 units) in that same time frame.

With increased volume and diminishing prices, remarketers will need to be more strategic about marketing those vehicles. Arbitrage — moving a vehicle for sale in a more lucrative market — should be part of your strategy in the upcoming years.

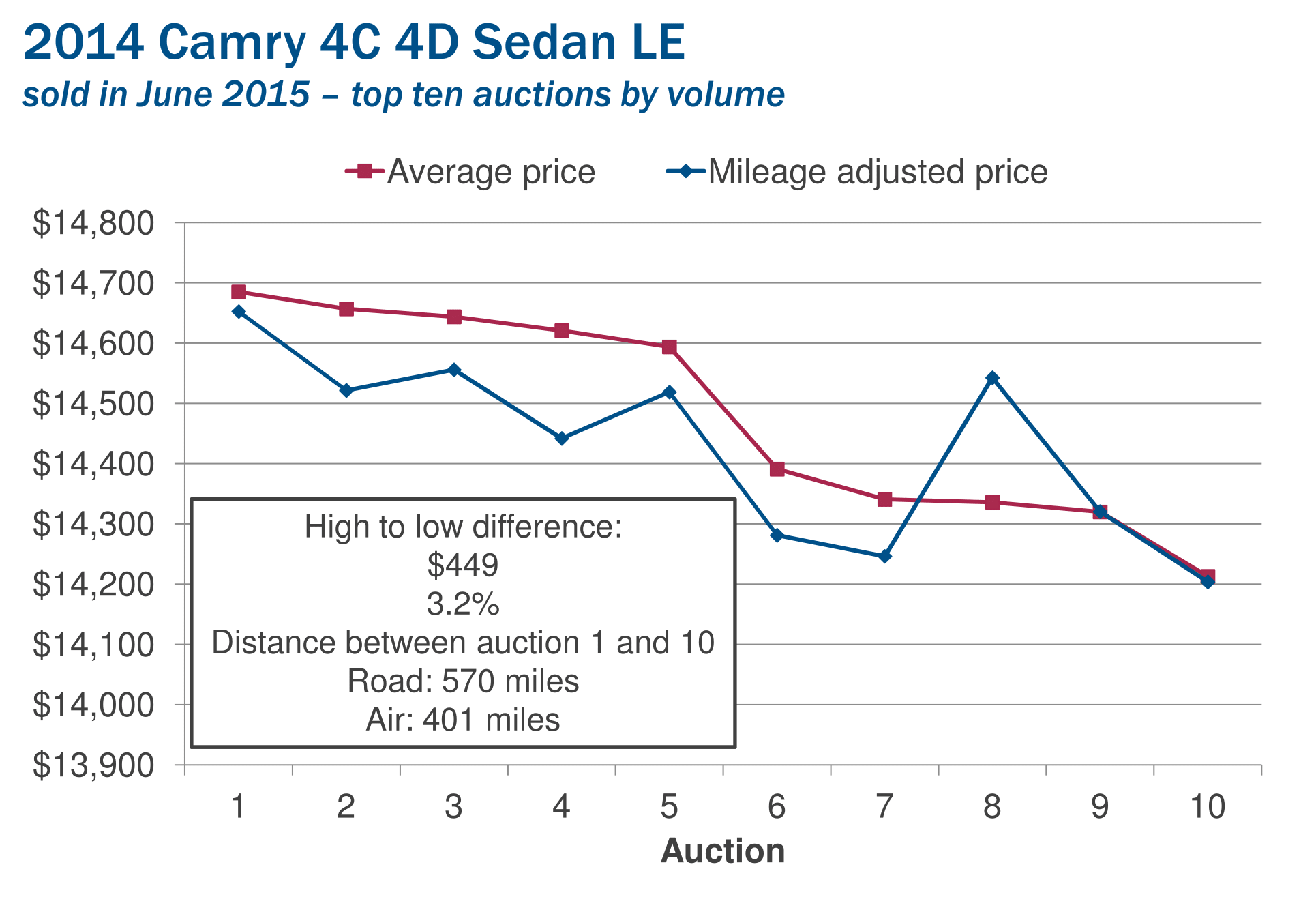

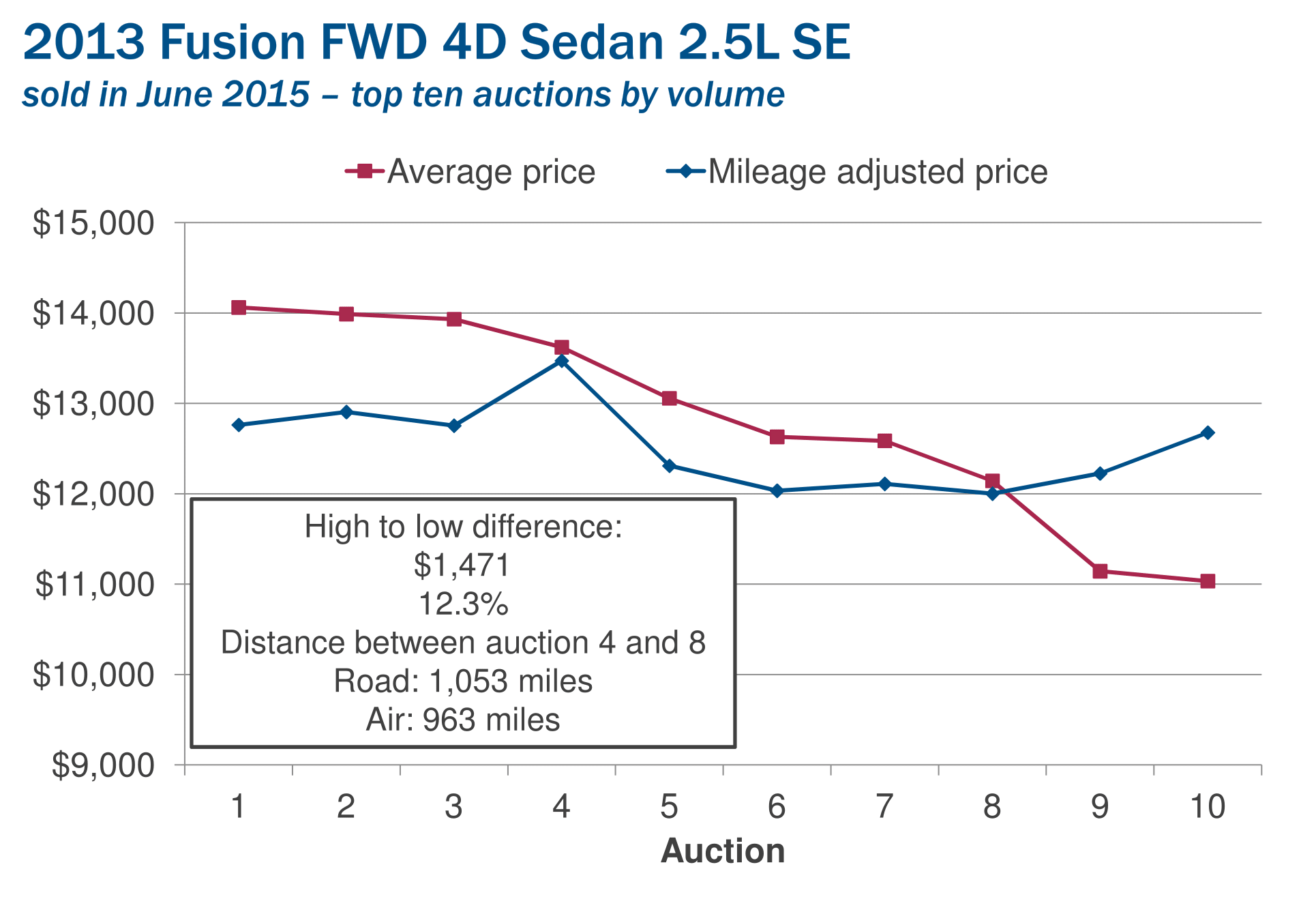

Webb illustrated how prices can fluctuate based on the market by providing examples of how the average unit sales price varied for the same make/model car between several auction locations. In one snapshot comparing 10 auction average sales 0-570 miles from origin, a 2014 Camry would have sold at a significantly higher price (mileage adjusted) at Auction 8, 450 miles away, and there was virtually no price difference if the vehicle had sold at Auctions 9 or 10, up to 570 miles from origin [see Figure 1]. In a second example, the mileage-adjusted price was $1,000+ higher than average for Auctions 9 and 10, even after adjusting for long-distance transport [see Figure 2].

Many software tools are available to help remarketers determine where to sell vehicles to get the best price. When planning your remarketing strategy, make sure to include your transportation provider(s), as they may be able to offer additional ways to save shipping costs and make arbitrage more effective. A proactive approach can save you time, hassle and money. Ask your sales rep how ShipCarsNow can make arbitrage work better for you.

Look for another installation of “Insights From the Forum” in next month’s issue of Ship Smarts.